Anne Phair was having some coffee with some friends one day, back when you could still do that. They were talking about the federal carbon tax. Anne said, “I was talking to some friends, most of which don't actually own their own businesses, and one was talking about how her grandma got some money back and she doesn't ever get money back. And she was so surprised and I'm like, ‘Yeah, that was my money.’”

The money that grandma got back was for the federal carbon tax. Anne and her husband Kevin own and operate Phair Oilfield Tank Truck Service Ltd., with operations based in Carnduff, while they live in Weyburn. The company hauls crude oil and salt water in the Carnduff area of Saskatchewan as well as southwest Manitoba.

“I could have walked around Weyburn and handed out hundred-dollar bills,” she said on Dec. 17 by phone. Indeed, she could have handed out precisely 172 of those crisp brown hundred-dollar bills in the first year, alone.

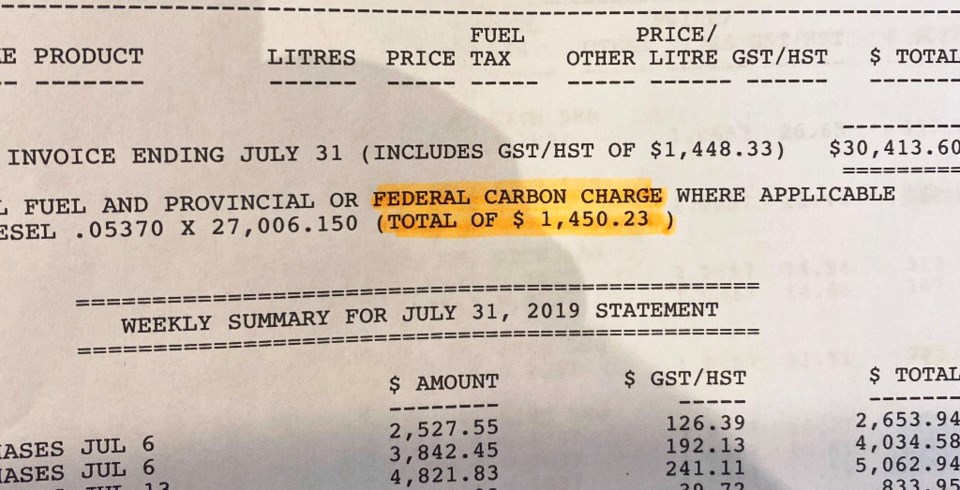

Anne could say this because she has kept meticulous records of every cent she can track that her company has paid in carbon tax, since day one. The first year alone – April 2019 to April 2020, they paid $17,200.71, and that was when the carbon tax was set at just $20 per tonne of CO2. From April until November, 2020, they had already paid over $10,000, with a carbon tax rate of $30 per tonne. The reason the number is tracking lower is due to the substantial drop in business this year, as the oilpatch has been hit hard as a result of the economic impact of the COVID-19 pandemic. And on Dec. 11, Prime Minister Justin Trudeau announced the carbon tax would be raised every year until 2030, when it would reach $170 per tonne.

To put that first year’s carbon tax in perspective, Anne said, “We have a daughter who just started university. Seventeen thousand dollars would have paid for her year, or close.”

Explaining how she came to that $17,200.71, Anne said, “I took the numbers off of the fuel bills and then I also took the numbers off of our natural gas bills for our shop and our house. We have the house in Carnduff that's owned by the business. And the office is in the Weyburn house, so I use the power bills and the heat bills off of the houses and the shop. And even our garbage disposal is charging a carbon charge on their bills.

“Anybody that wrote anything about carbon tax on a bill went on my spreadsheet.

“I kept it all.”

December of 2019 was a $2,000 month just for carbon tax, almost all of that on the fuel their trucks use.

Customers refuse to cover the carbon tax

Phair Oilfield Tank Truck Service runs a fleet of four of their own trucks, plus a number of trailers pulled by leased operators. They used to have 14 people working, in total, including the owners, but more recently that’s down to Kevin, Anne, two company drivers and three leased operators. Like nearly all the oilpatch, their business had been dramatically diminished since the crash in oil prices in late 2014 led to a brutal oil downturn that has now lasted six years. They have seen several rounds of cuts in the rates their customers will allow them to charge. When that downturn hit, they took 10 per cent off their rates off the top, and have yet to get any of that back.

And it’s not like they can just tack on the carbon tax on their invoices. Most oil companies refuse to pay for additional carbon tax on their invoices, according to Kevin, although one company does specify a fuel surcharge they are willing to pay.

“We were told, ‘Do not charge it,’” Anne said.

The result is the Phairs, like most other company owners in the oilpatch, have absorb the additional cost. Every time the carbon tax ratchets up, they are absorbing it. “We are eating every dime. It comes out of my pocket,” Anne said.

“I can’t even picture $170. I don’t even think we’re in business anymore, unless something changes,” she said of the progressively higher carbon tax in the coming years.

When the carbon tax hits $95 per tonne in 2025, based on their 2019 numbers, the Phairs would be paying $81,700 in that year alone, enough to employ one more driver.

Asked where that $81,700 comes from, they both laughed. “If you know, please tell us,” Anne said.

Getting more serious, Kevin said, “It comes out of our retirement, that’s where it comes; out of paying for anything new. It comes from updating your equipment.”

Can they get more GHG efficient?

One of the stated reasons behind the carbon tax is to encourage a reduction in the consumption of greenhouse gas generating fuels. Asked if there’s anything they could do to reduce their consumption, Kevin said they could remove the emissions controls off their truck engines, something the government clearly does not want. Their predicament is compounded by the fact that progressive tiers of emissions controls on diesel engines, now at Tier IV for new engines, have proven to be increasingly problematic, maintenance-wise, and less fuel efficient. While they dramatically reduce pollutants like NOx and particulates, they also actually increase fuel consumption.

As for the possibility of getting an electric semi, Kevin scoffed, referring to an oilfield lease in the middle of the prairie and noting, “You won’t find a charge station anywhere near 1-25-2-1-W2, that’s for sure.”

Anne added, “And how do you find the money to go and replace your entire fleet? Especially when the equipment you already have is now basically unmarketable? You can't even turn around and sell what you got.”

“We won't be buying any new equipment from here on out, and that'll be where we have to save some money, I guess.”

“It comes out of your ability to help your kids get started, maybe start a business of their own, or with a down payment on a house,” Kevin said.

“It also comes out of what we can give back to the community,” Anne said, citing examples of donations to the local rink or sports teams that won’t be happening.

While the general public may see a carbon tax rebate on their taxes, that’s not the case for businesses like Phair Oilfield Tank Truck Service. Every quarter, Anne fills out a form called “Fuel Charge Return – Registrant.” The form says, “Use this form to calculate your total net charge in accordance with section 71 of the Greenhouse Gas Pollution Pricing Act.”

She forwarded a copy of their second quarter 2019 form. They claimed $27.19 from Manitoba, and got a rebate of $27.19 from Saskatchewan, for a net zero. One time, they got all of three dollars back, for a trip to Alberta, because Alberta has its own carbon pricing scheme.

Anne has spoken with her Member of Parliament, Souris-Moose Mountain Conservative MP Robert Kitchen about it. She’s written letters to the prime minister. A response she got from the federal government told her to apply on her income tax rebate for a few hundred dollars. For 2019, they would get $305 for the first adult, $152 for the second, $76 for each child, and a 10 per cent boost for living in a rural area of Saskatchewan, according to the Government of Canada website.

“Thanks, paid $17,000, and I get back, what? That’s helpful,” Anne concluded.